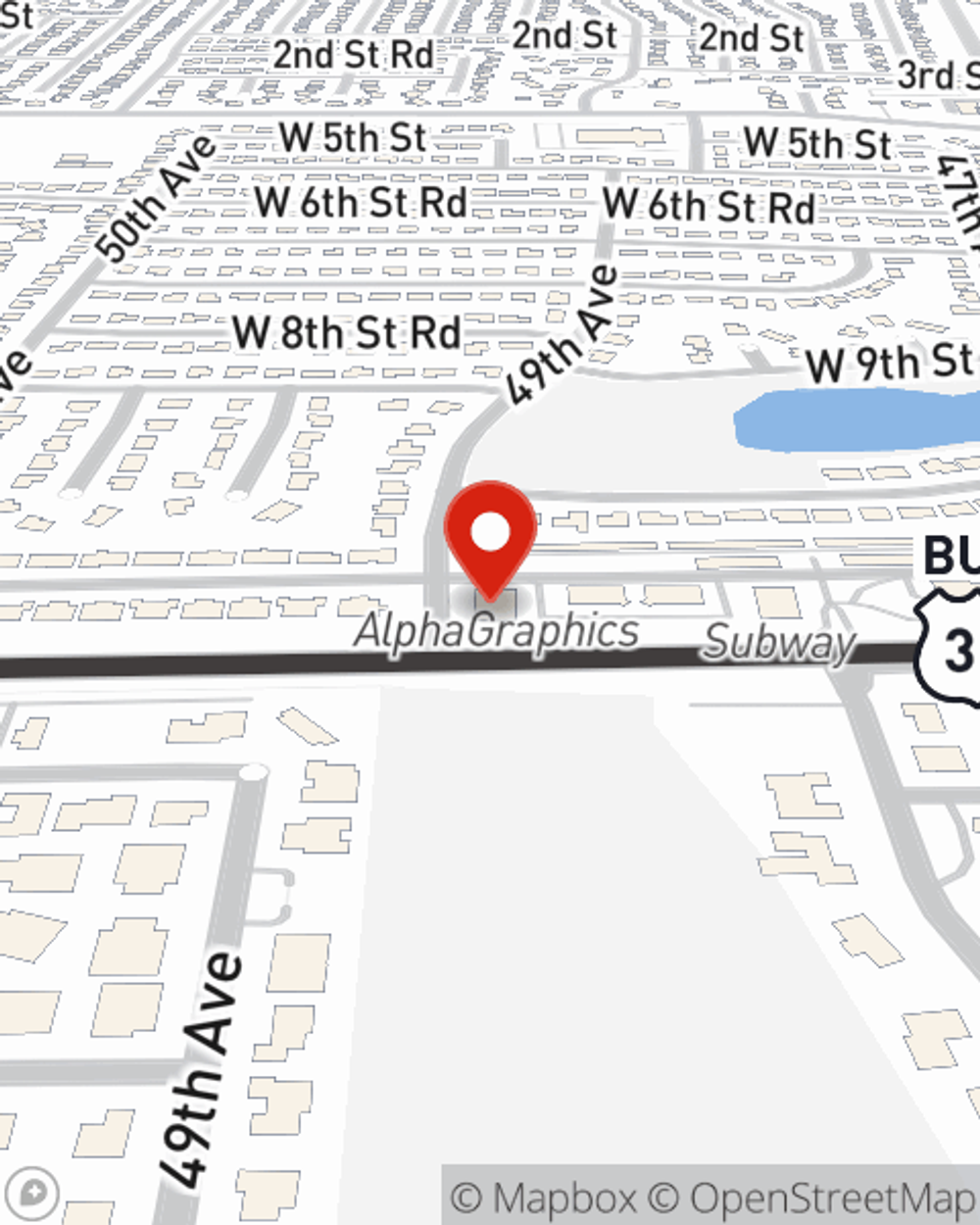

Business Insurance in and around Greeley

Get your Greeley business covered, right here!

Insure your business, intentionally

- Greeley

- Evans

- Eaton

- Windsor

- Johnstown

- Severance

- Gilcrest

- Fort Collins

- Loveland

- Platteville

- Brighton

- Laporte

- Wellington

- Nunn

- Pierce

- Carr

- Weld County

- Larimer County

- Kersey

- Galeton

- Grover

- Longmont

- Boulder

- Estes Park

Help Protect Your Business With State Farm.

Running a small business is no joke. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, contractors, trades and more!

Get your Greeley business covered, right here!

Insure your business, intentionally

Insurance Designed For Small Business

Your business is unique and faces a different set of challenges. Whether you are growing a clock shop or a clothing store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your location, you may need more than just business property insurance. State Farm Agent Mark Llewellyn can help with business continuity plans as well as key employee insurance.

As a small business owner as well, agent Mark Llewellyn understands that there is a lot on your plate. Get in touch with Mark Llewellyn today to discuss your options.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Mark Llewellyn

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.